|

There is an abundance

of clean, renewable, wind and solar energy that can produce green hydrogen and

electricity to charge vehicle batteries, but there is no transport

infrastructure to support rapid energy exchanges, refuel hydrogen vehicles

and load level.

UKRAINIAN

ELECTRICITY PRICES

The war in

Ukraine has significantly impacted Russian electricity prices, leading to a complex and multifaceted energy crisis.

There is a clear link between peacetime and reliable energy prices and and

disruptive aggression, that creates turmoil and unpredictable supplies.

Let’s delve into the key changes and consequences:

HIGHER ENERGY PRICES

Energy prices are rising, with high fuel costs accounting for 90% of the increase in average costs for electricity generation worldwide.

Approximately 70 million people who recently gained access to electricity now find it unaffordable due to these rising prices.

Additionally, around 100 million people may no longer be able to cook using clean fuels and might revert to using biomass

instead [1].

CHANGING

TRADE FLOWS & SUPPLY SHORTAGES

The war has disrupted energy markets, leading to volatility and uncertainty.

Strict sanctions on the Russian energy sector have further complicated supply dynamics.

Markets are grappling with assessing the potential implications for global energy

supplies [1].

Are

their any positive aspects amid the crisis?

While the situation is challenging, higher fossil fuel prices provide strong incentives to accelerate the transition toward sustainable alternatives.

However, the need for energy security may still drive investment in fossil fuel projects [1].

The war in Ukraine has had a profound impact on global energy markets, particularly oil and gas prices. Let’s explore how the free world responded to this

crisis.

Following Russia’s invasion of Ukraine, oil prices surged to over $110 per barrel. This represented a significant increase from previous levels.

Major oil benchmarks traded above $110, reflecting a 15% rise in just one

week [6].

The risk of supply disruptions was not fully priced in, and further upward movement was anticipated.

The war in Ukraine has generated a sharp increase in energy prices and significant volatility in energy markets. Amid fears of disruptions to energy supplies and increasingly strict sanctions on the Russian energy sector, prices have fluctuated, in particular as markets have tried to assess the potential implications for global energy supplies. Given their heavy reliance on Russian supplies before the invasion, euro area energy markets have been especially affected. This box provides an overview of the impact that the war in Ukraine has had on euro area energy markets so far. It outlines Russia’s role in the euro area’s energy supply and looks at measures that have influenced prices. In this context, it also discusses the implications for euro area energy commodity and consumer prices.

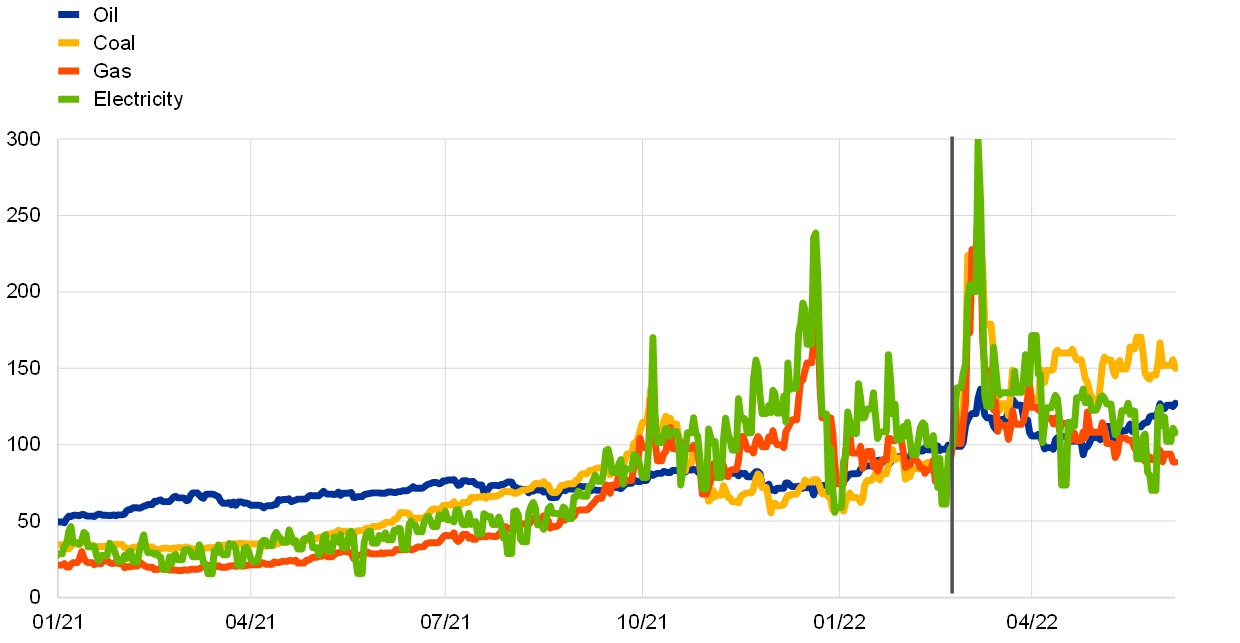

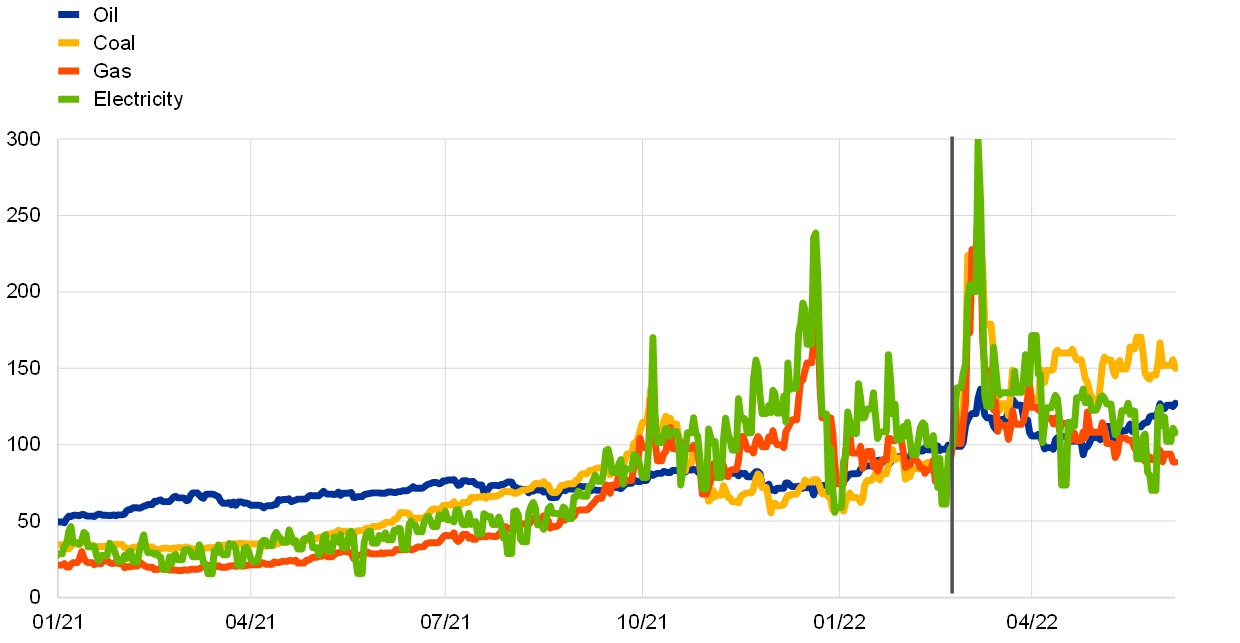

Oil, coal and gas prices spiked in the immediate aftermath of Russia’s invasion of Ukraine and have been volatile ever since. Energy commodity price volatility began mounting in December 2021 when reports of a potential Russian invasion of Ukraine increased. In the first two weeks after the invasion, the prices of oil, coal and gas went up by around 40%, 130% and 180% respectively (Chart A). Gas prices also drove up wholesale electricity prices in the euro area. Since then energy commodity prices have moderated, with oil and coal prices standing 27% and 50% respectively above their levels before the invasion, while gas prices are 11% lower than before the invasion. Oil prices have recently started to increase again, reflecting the EU’s agreement to embargo most Russian oil imports and the higher global demand for oil owing to China’s easing of

COVID-19 restrictions. Wholesale electricity prices are 8% higher than before the invasion but have remained very volatile, affected in particular by policy measures taken in response to the price increases.

Strains on energy supplies from Russia may affect the euro area via both world market prices and direct supplies. In 2019 Russia’s energy production accounted for 12% of the global supply of oil, 5% of coal and 16% of gas. In 2021 the country was the largest supplier of energy commodities to the euro area, constituting 23% of total energy imports. Russia accounted for 23% and 43% of euro area crude oil and coal imports respectively in 2020, which represented 9% and 2% of the euro area’s primary energy consumption. However, the euro area is particularly dependent on natural gas imports from Russia, which in 2020 amounted to 35% of euro area gas imports and represented 11% of the euro area’s primary energy consumption.[1] Germany and Italy have the highest dependence on Russian gas among the large euro area countries. The degree of substitutability of these energy sources is relevant to any analysis of the economic implications of the war for energy prices and euro area supplies.

The European Union introduced economic sanctions targeting the Russian energy industry, most notably the coal and oil sectors. The sanctions also include a ban on EU exports of goods and cutting-edge technology used to develop the Russian oil and gas sectors. Moreover, the EU has prohibited the import of Russian coal as of August 2022. At the special meeting of the European Council at the end of May, it was decided to stop most Russian oil imports. The agreements foresee a ban on all seaborne oil shipments from Russia by the end of the year, with a temporary exemption for crude oil delivered via pipeline. While seaborne oil accounts for around two-thirds of total imports of oil from Russia, the embargo is expected to effectively encompass around 90% of oil imports from Russia, as Germany and Poland are reported to have pledged to stop importing pipeline oil.[2]

Immediately after Russia’s invasion of Ukraine, European companies started “self-sanctioning”; energy, shipping and insurance companies cut ties with the Russian energy sector, leading to a 23% drop in shipments of Russian oil to Europe in March. Russia has been able to redirect oil exports to other destinations such as India, but signs of significant, persistent reductions in Russian oil production are emerging, with the Russian oil supply projected to fall by 25% in the second half of 2022 relative to the beginning of the year.[3] Continued low Russian production levels are pointing to increased tightness in the global oil market, unless other main producers speed up production.[4] This would result in downward revisions to global oil supply forecasts for the rest of the year of around 3% since the start of the invasion.

CHART

'A'

[1] Natural gas is the second most important primary energy resource in the euro area, after petroleum-based products.

[2] After the invasion of Ukraine, the United States, the United Kingdom and Canada banned all imports of oil and gas from Russia. However, the EU is a significantly larger importer of Russian energy and its sanctions will have a greater effect on the Russian energy sector.

[3] Production of crude oil dropped by around 1 million barrels per day to 10 million barrels per day in April.

[4] On 2 June the OPEC+ group of oil-producing countries decided to accelerate oil production in July and August by almost 0.65 million barrels per day, up from planned increases of around 0.4 million barrels per day. This production increase is not large enough to compensate fully for Russian supply shortfalls.

[5] The intention is for the EU to become completely independent of Russian fossil fuels well before 2030 by following a set of initiatives such as diversifying fossil fuel supplies, saving energy, expediting the roll-out of renewable energy and replacing fossil fuels in heating and power generation.

[6] Since Russia’s invasion of Ukraine, a small fraction of gas imports has been substituted by increased imports from other suppliers such as Norway. Germany has reduced its gas imports from Russia, down from 55% to 45%, and aims to become almost independent by 2024. Italy has announced it will phase out Russian imports completely by the end of 2024, buying from other suppliers such as Algeria. Estonia, Latvia and Lithuania have also stopped importing Russian gas as part of European efforts to curb reliance on Russian energy.

[7] In March the IEA announced a strategic release of 60 million barrels in total from their reserves, with the United States supplying 50% of the release. This was followed by a second announcement in April that 1.3 million barrels per day would be released over six months, with 1 million barrels per day coming from the United States.

[8] The contribution of liquid fuels, electricity and gas was 22, 12 and 10 percentage points respectively in March and 17, 9 and 10 percentage points in April.

[9] Wholesale electricity prices in Europe are strongly influenced by the price of natural gas, with gas-fired electricity generation often being the marginal technology that sets wholesale electricity prices.

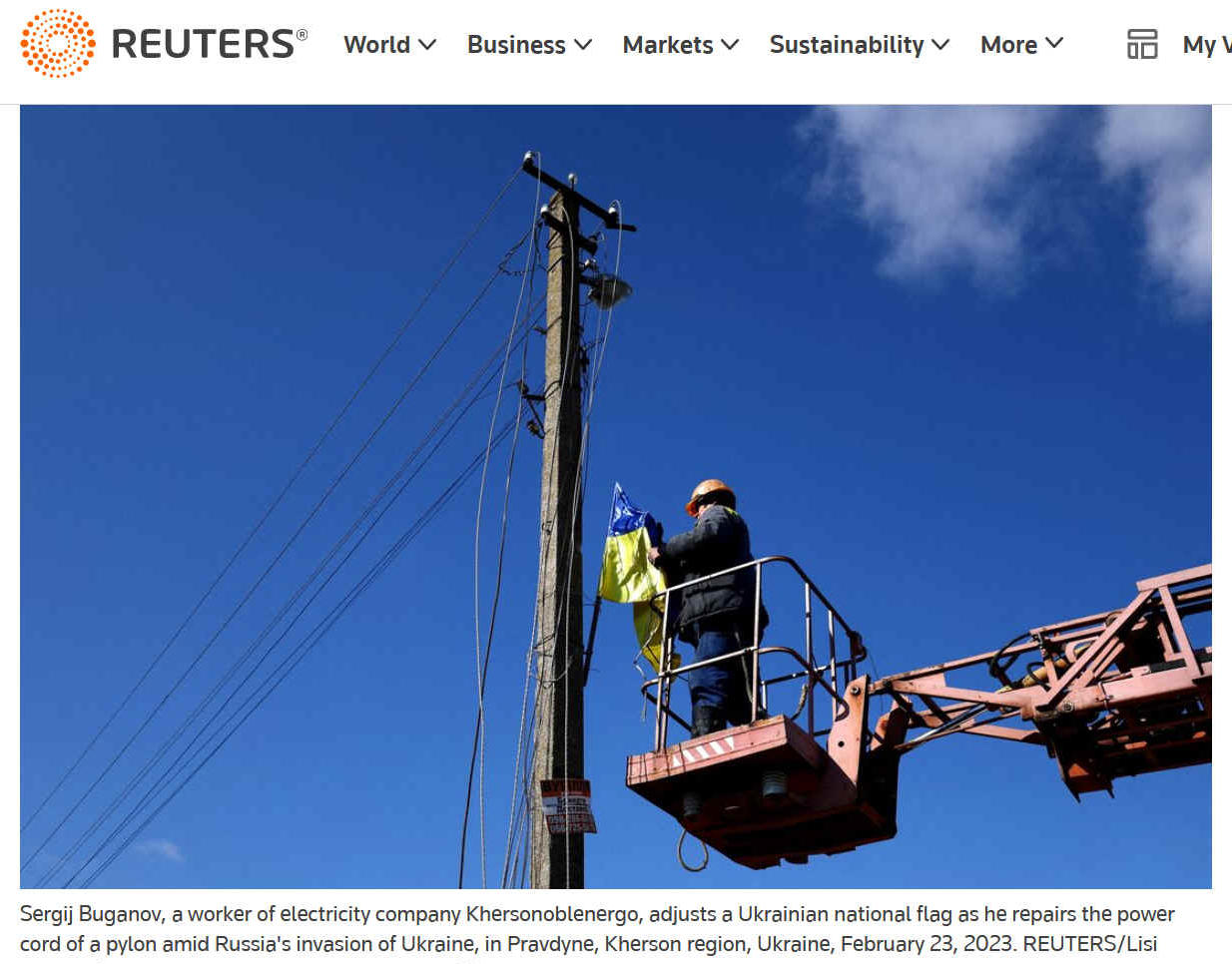

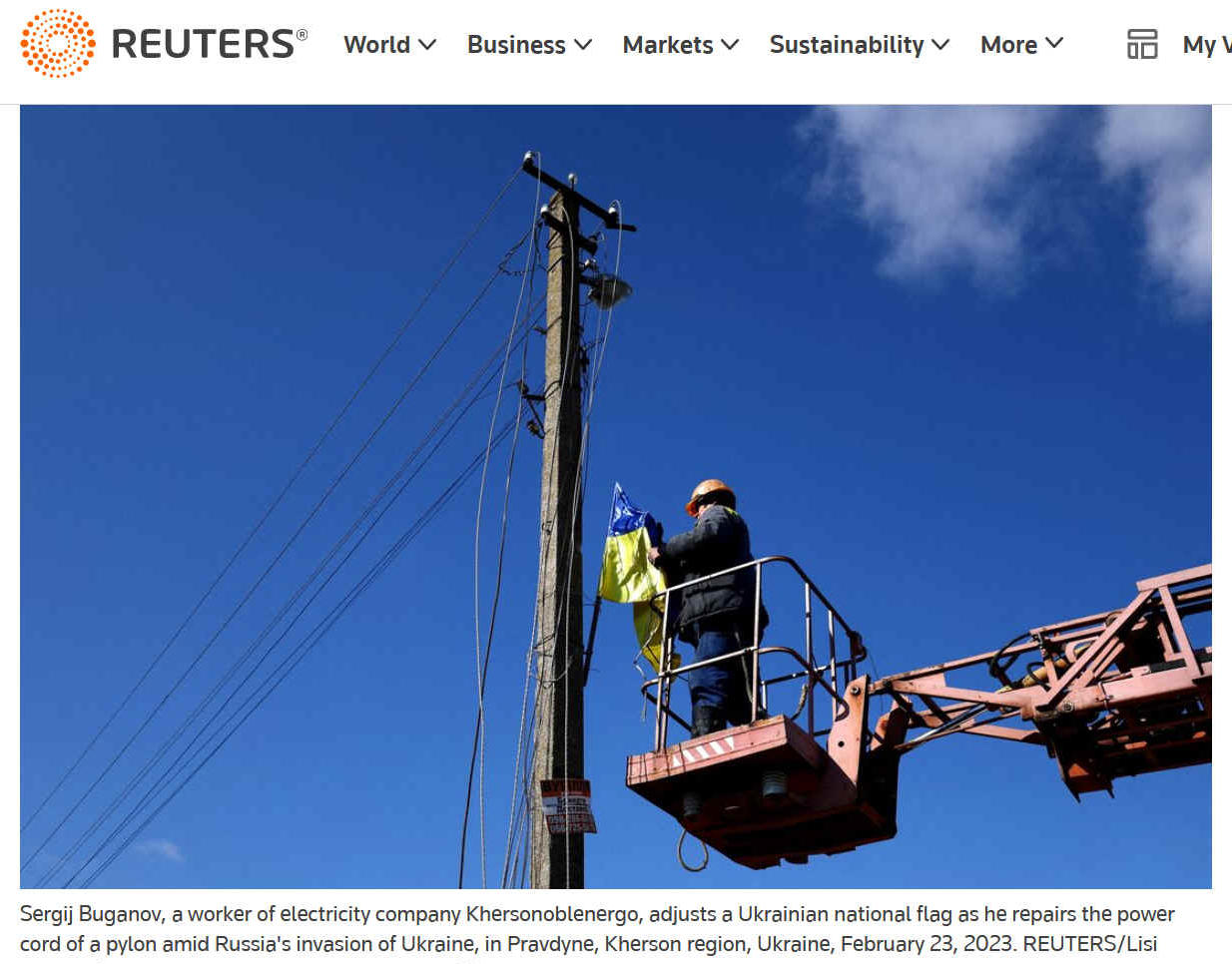

REUTERS 31 MAY 2023 - UKRAINE RAISES CONSUMER UTILITY TARIFFS TO HELP POWER GRID REPAIRS

KYIV, May 31 (Reuters) - Ukraine will increase consumer electricity tariffs from Thursday to strengthen its energy system and to prepare for next winter following months of Russian air strikes, officials said on Wednesday.

Russian missile and drone attacks on power infrastructure at times deprived millions of people of electricity and heating during the cold winter months. Officials have said that about 50% of Ukraine's energy infrastructure was damaged.

"Ukraine survived through the most complicated winter in its history amid mass Russian attacks on the energy system. Now the largest repair campaign of the energy infrastructure since Ukraine's independence is underway," said Energy Minister German

Galushchenko.

"The scale of damages and losses are significant. The tariff increase is the contribution to ensure the system's stability.”

The government said in a statement that electricity tariffs for the population would be nearly doubled to 2.64 hryvnias ($0.0715) per kilowatt-hour from June 1.

The government has until now kept utility tariffs flat since the start of Russia's full-scale invasion in February 2022, During the war, poverty rates have soared, with many Ukrainians losing their jobs, fleeing their homes for safer areas, and facing a higher cost of living.

"We assume that attacks on the energy facilities will be as systematic during the next heating season as last winter. We should use all possible resources to renew and defend the facilities," Galushchenko said.

The Kyiv School of Economics has estimated that damage to Ukraine's energy infrastructure was about $8.3 billion as of this April.

Energy experts and engineers have been working on moving some energy facilities as far as possible underground to protect them from attacks, officials have said.

($1 = 36.9300 hryvnias)

AFRICAN

ELECTRICITY PRICES

AUSTRALASIAN

ELECTRICITY PRICES

CANADIAN

ELECTRICITY PRICES

CHINESE ELECTRICITY PRICES

EUROPEAN

ELECTRICITY PRICES

MIDDLE

EASTERN ELECTRICITY PRICES

NORTH

AMERICAN ELECTRICITY PRICES

(USA)

RUSSIAN

ELECTRICITY

PRICES

SOUTH

AMERICAN ELECTRICITY

PRICES

SOUTH

ASIAN ELECTRICITY PRICES

UKRAINIAN

ELECTRICITY PRICES

ELECTRICITY

PRICES UNITED KINGDOM

As

you may imagine, if you are running a business that uses lots of energy.

Location is an important factor in remaining competitive. Industry could be

based near the Sahara desert, where massive solar installations make sense.

And yet, there is little by way of industrial activity. Africa, is thus a

blossoming energy market. Recognised in both the EGYPES

and ADIPEC

energy shows. With many other events concentrating on renewables like green hydrogen

and electrolyzers.

The following is a a performance league table for best electricity prices, ranking countries from the cheapest to the most expensive based on the information

available on the web. Remember that these rankings are subject to change over time, but as of the data

available in March 2024, here’s a top ten list:

Sudan: USD 0.006 per kWh (household price)

Kyrgyzstan: USD 0.049 per kWh (household price)

Bulgaria: USD 0.078 per kWh (average household price)

Hungary: USD 0.078 per kWh (average household price)

Malta: USD 0.078 per kWh (average household price)

Kazakhstan: USD 0.079 per kWh (household price)

Uzbekistan: USD 0.080 per kWh (household price)

Tajikistan: USD 0.081 per kWh (household price)

Turkmenistan: USD 0.082 per kWh (household price)

Moldova: USD 0.083 per kWh (household price)

Please note that these rankings may not reflect the current situation. Factors such as subsidies, energy mix, and economic conditions contribute to these prices. We’ll explore the means of electricity generation in more depth later.

Let’s take a look at the electricity prices in Sudan and Kyrgyzstan, along with their potential connections to sustainability and the

United Nations

Sustainable Development Goal 7 (SDG 7).

ELECTRICITY PRICES IN SUDAN

As of June 2023, the price of electricity in Sudan is remarkably low. Here are the details:

- Household Price: SDG 5.000 per kilowatt-hour (kWh) or approximately USD 0.006 per kWh.

- Business Price: SDG 26.000 per kWh or approximately USD 0.029 per kWh.

These prices include all components of the electricity bill, such as the cost of power, distribution, and taxes. For comparison, the average global electricity price during that period was around USD 0.154 per kWh for households and USD 0.151 per kWh for

businesses.

ELECTRICITY PRICES IN KYRGYSTAN

In Kyrgyzstan, the electricity prices are also notably low. As of June 2023:

Household Price: KZT 22.070 per kWh or approximately USD 0.049 per kWh.

Business Price: KZT 28.850 per kWh or approximately USD 0.064 per kWh.

Again, these prices include all components of the electricity bill. Kyrgyzstan’s low electricity prices contribute to its energy affordability for both households and businesses. However, it’s essential to understand the context behind these prices.

POSSIBLE REASONS FOR LOW PRICES

Energy Mix: Both Sudan and Kyrgyzstan have diverse energy sources, including hydropower and other renewables. Hydropower, being a renewable resource, often leads to lower electricity

costs, begging the question why is electricity priced higher in Canada.

Subsidies: Governments in these countries may provide subsidies to keep electricity prices affordable for citizens. These subsidies can help mitigate the cost of power generation.

Economic Factors: Economic conditions, currency exchange rates, and overall development levels influence energy prices. Lower costs of production and distribution can contribute to lower prices.

Historical Context: Historical energy policies and infrastructure investments play a role. For example, Kyrgyzstan has a long-standing tradition of hydropower development.

CONNECTION

TO SDG 7

SDG 7 aims to ensure access to affordable, reliable, sustainable, and modern energy for all. Both Sudan and Kyrgyzstan’s low electricity prices align with this goal. By providing affordable energy, they contribute to economic development, poverty reduction, and improved living standards. However, it’s essential to balance affordability with environmental sustainability and climate change mitigation.

Efforts to achieve SDG 7 involve enhancing energy efficiency, promoting renewable energy sources, and fostering international cooperation. Both countries can continue working toward sustainable energy systems while ensuring affordability for their

citizens.

Please note that exchange rates can fluctuate, so it’s essential to check real-time rates for precise conversions.

Anyway you look at it, in the EU consumers are being ripped off, to benefit

rich shareholding investors. Maybe, it's time for change? To allow the

people, to take back control of their energy prices. We cannot help but make

a reference to Financial Slavery at this point. Because, high food and

energy prices lead to food and energy poverty. Kicking in other UN

SDGs: 1,

2,

3

and 10,

11,

12.

BASIC

HUMAN RIGHTS

Electricity

should be cheaply available to all, as a basic human

right. As per Sustainability

Development Goal 7. It is the duty of every government to strive to

achieve affordable clean energy for their administrative geographical region. Profits should not

come into the frame, where it introduces energy poverty, or financial

slavery. Privatization of existing grids can lead to a focus on shareholder profits over

grid modernization and expansion, making electricity less affordable for low-income populations. This is particularly detrimental in developing nations where access to reliable energy is crucial for basic needs and development.

Unfortunately, in Russia, the total lack of free elections, undermines the

democratic process, regardless of the electricity supply price. Vladimir

Putin's dictatorship encourages their billionaires to invest overseas,

by way of Imperialist back door expansion. Another good reason not to allow

foreign investment in land in another nation. Such practices, if not limited

to one house per foreign national, threatens the sovereignty of the host

nation. Apart from the money laundering element of such transactions.

PROFITEERING

& MORALS

You

may be asking why people should profit from energy and is that legal?

Mostly, energy companies have shareholders who derive an income based on

share dividends. Sometimes those energy companies would rather they grab a

nice profit for themselves, rather than invest in renewables and

infrastructure (storage), to make electricity cheaper for their customers.

If this is happening in your region, it is because politicians are allowing

it to continue. Whereas, policy changes, as statutory requirements - making

it law, could force suppliers to invest first, with dividends later.

Provided only that a good level of investment has been made. Otherwise,

suppliers, and of course the infrastructure network (in the UK Power

Networks) should lose their franchise.

THE

CASE FOR NATIONALIZATION

The

alternative is nationalization, where there are no dividends or shareholders

to leach off a captive market. Then, the matter of procurement fraud may

rise to the surface as something to keep an eye open for. As in tender bids

and transparent tendering. A State operated Grid, Power Storage, and State

operated Power Stations, Solar

and Wind

Farms, would seem to be the only way that SDG7 might be complied with.

https://www.globalpetrolprices.com/Russia/electricity_prices/

https://www.statista.com/statistics/263492/electricity-prices-in-selected-countries/

https://www.pragya.org/

https://www.mppmcl.com/

https://anocab.com/

https://www.expatica.com/ru/living/household/utilities-in-russia-970011/

https://www.statista.com/topics/9680/energy-sector-in-russia/

https://medium.com/intratec-products-blog/electricity-price-russia-q1-2023-e4d3d61bfc2d [1]

https://www.weforum.org/agenda/2022/11/russia-ukraine-invasion-global-energy-crisis/

[2] https://www.ecb.europa.eu/press/economic-bulletin/focus/2022/html/ecb.ebbox202204_01~68ef3c3dc6.en.html

[3] https://www.cer.eu/insights/impact-ukraine-war-global-energy-markets

[4] https://www.weforum.org/agenda/2023/02/russia-ukraine-war-energy-costs/

[5] https://www.nbcnews.com/news/world/why-russia-s-ukraine-invasion-spiked-energy-prices-4-charts-n1289799

[6] https://www.weforum.org/agenda/2022/03/how-does-the-war-in-ukraine-affect-oil-prices/

[7] https://www.bbc.co.uk/news/business-60473233

[8] https://www.bbc.com/news/business-63855030

[9] https://en.wikipedia.org/wiki/International_response_to_the_Rwandan_genocide

[10] https://www.itv.com/news/2022-02-24/how-has-the-world-reacted-to-russias-military-operation-in-ukraine

[11] https://www.bbc.co.uk/bitesize/guides/z9hnqhv/revision/6

[12] https://www.jfklibrary.org/learn/about-jfk/jfk-in-history/the-cold-war-in-berlin https://www.ecb.europa.eu/press/economic-bulletin/focus/2022/html/ecb.ebbox202204_01~68ef3c3dc6.en.html https://www.ecb.europa.eu/press/economic-bulletin/focus/2022/html/ecb.ebbox202204_01~68ef3c3dc6.en.html https://earth-planet.org/ https://earth-planet.org/

https://www.reuters.com/business/energy/ukraine-raises-consumer-utility-tariffs-help-power-grid-repairs-2023-05-31/ [1]

https://www.weforum.org/agenda/2022/11/russia-ukraine-invasion-global-energy-crisis/

[2] https://www.ecb.europa.eu/press/economic-bulletin/focus/2022/html/ecb.ebbox202204_01~68ef3c3dc6.en.html

[3] https://www.cer.eu/insights/impact-ukraine-war-global-energy-markets

[4] https://www.weforum.org/agenda/2023/02/russia-ukraine-war-energy-costs/

[5] https://www.nbcnews.com/news/world/why-russia-s-ukraine-invasion-spiked-energy-prices-4-charts-n1289799

[6] https://www.weforum.org/agenda/2022/03/how-does-the-war-in-ukraine-affect-oil-prices/

[7] https://www.bbc.co.uk/news/business-60473233

[8] https://www.bbc.com/news/business-63855030

[9] https://en.wikipedia.org/wiki/International_response_to_the_Rwandan_genocide

[10] https://www.itv.com/news/2022-02-24/how-has-the-world-reacted-to-russias-military-operation-in-ukraine

[11] https://www.bbc.co.uk/bitesize/guides/z9hnqhv/revision/6

[12] https://www.jfklibrary.org/learn/about-jfk/jfk-in-history/the-cold-war-in-berlin https://www.globalpetrolprices.com/Russia/electricity_prices/

https://www.statista.com/statistics/263492/electricity-prices-in-selected-countries/

https://www.pragya.org/

https://www.mppmcl.com/

https://anocab.com/

https://www.expatica.com/ru/living/household/utilities-in-russia-970011/

https://www.statista.com/topics/9680/energy-sector-in-russia/

https://medium.com/intratec-products-blog/electricity-price-russia-q1-2023-e4d3d61bfc2d

Please

use our A-Z

INDEX to navigate this site

This

website is provided on a free basis to

promote zero emission transport from renewable energy in Europe and Internationally.

Copyright ©

Universal Smart Batteries and Climate Change Trust 2024. Solar

Studios, BN271RF, United Kingdom.

|