|

There is an abundance

of clean, renewable, wind and solar energy that can produce green hydrogen and

electricity to charge vehicle batteries, but there is no transport

infrastructure to support rapid energy exchanges, refuel hydrogen vehicles

and load level.

CHINESE ELECTRICITY PRICES

For households, the electricity price in China is approximately 7.6 U.S. dollar cents per kilowatt-hour (kWh)

[1] [2].

For businesses, the price is around 8.9 cents per kWh [3].

BBC NEWS 29 JANUARY 2024 - EVERGRANDE

The crisis at the world's most indebted property developer Evergrande has deepened as a court in Hong Kong ordered the company to be wound up.

Trading in the company's shares was suspended in Hong Kong after the ruling.

It marks another blow to the troubled firm which in 2021 was declared to be in default after missing a crucial repayment deadline, triggering China's current real estate market crisis.

Last September, its chairman was placed under police surveillance following earlier reports that other current and former executives at Chinese property giant Evergrande had also been detained.

WHAT

DOES EVERGRANDE DO ?

Businessman Hui Ka Yan founded Evergrande, formerly known as the Hengda Group, in 1996 in Guangzhou, southern China.

According to the company's website, Evergrande Real Estate currently owns more than 1,300 projects in more than 280 cities across

China.

The broader Evergrande Group encompasses far more than just real estate development.

Its businesses range from wealth management to making electric cars and food and drink manufacturing. It even owns a controlling stake in what was one of the country's biggest

football teams, Guangzhou FC.

Mr Hui was once Asia's richest person with his fortune estimated at $42.5bn (£34.8bn) by Forbes, but his wealth has plummeted since then, largely as Evergrande's problems have grown.

WHY

IS EVERGRANDE IN TROUBLE ?

Evergrande expanded aggressively to become one of China's biggest companies by borrowing more than $300bn.

In 2020, Beijing brought in new rules to control the amount owed by big real estate developers.

The new measures led Evergrande to offer its properties at major discounts to ensure money was coming in to keep the business afloat.

Now it is struggling to meet the interest payments on its debts.

This uncertainty has seen Evergrande's shares lose 99% of their value in the past three years.

Last August, the firm filed for bankruptcy in New York, in a bid to protect its US assets as it worked on a multi-billion dollar deal with creditors.

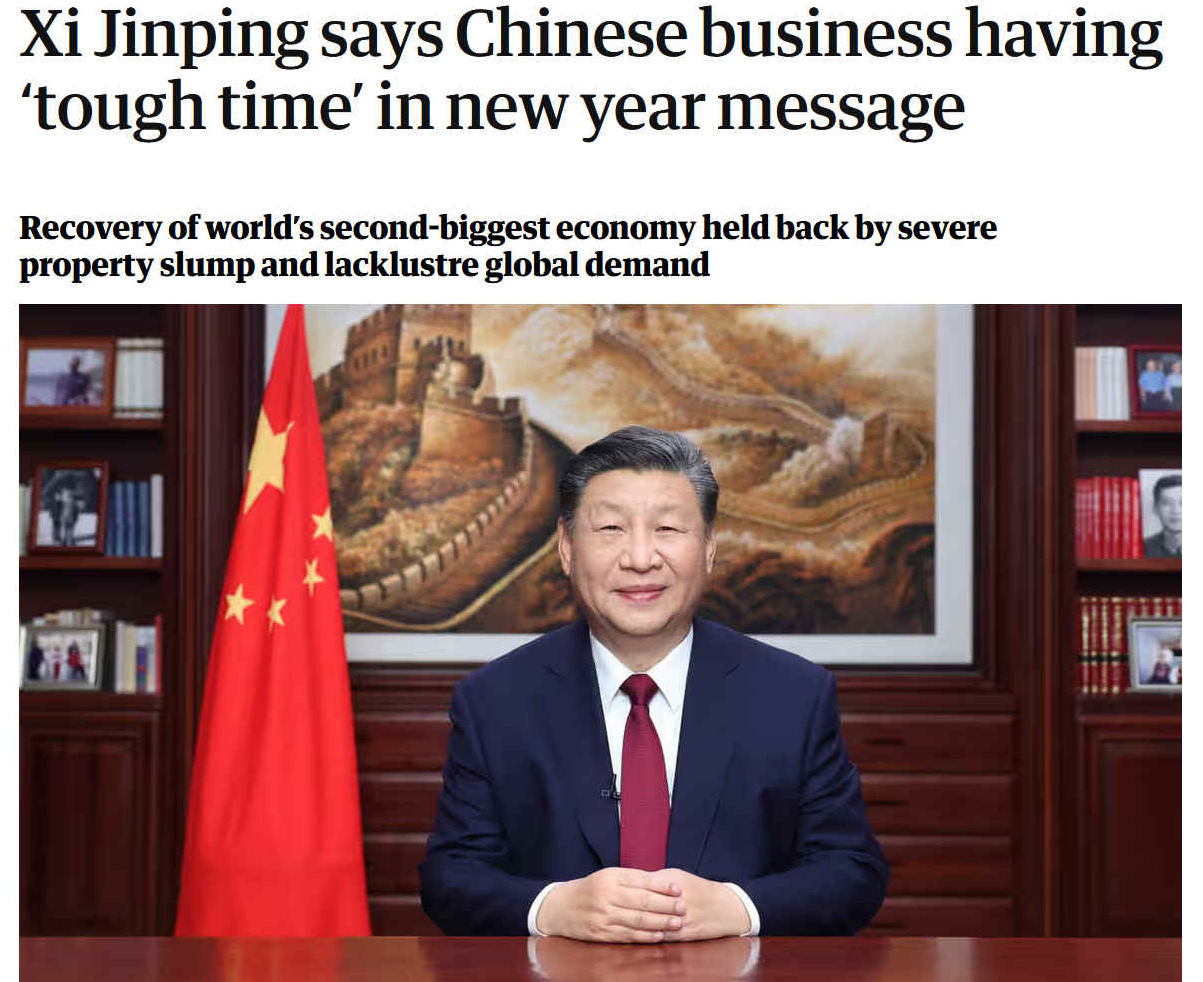

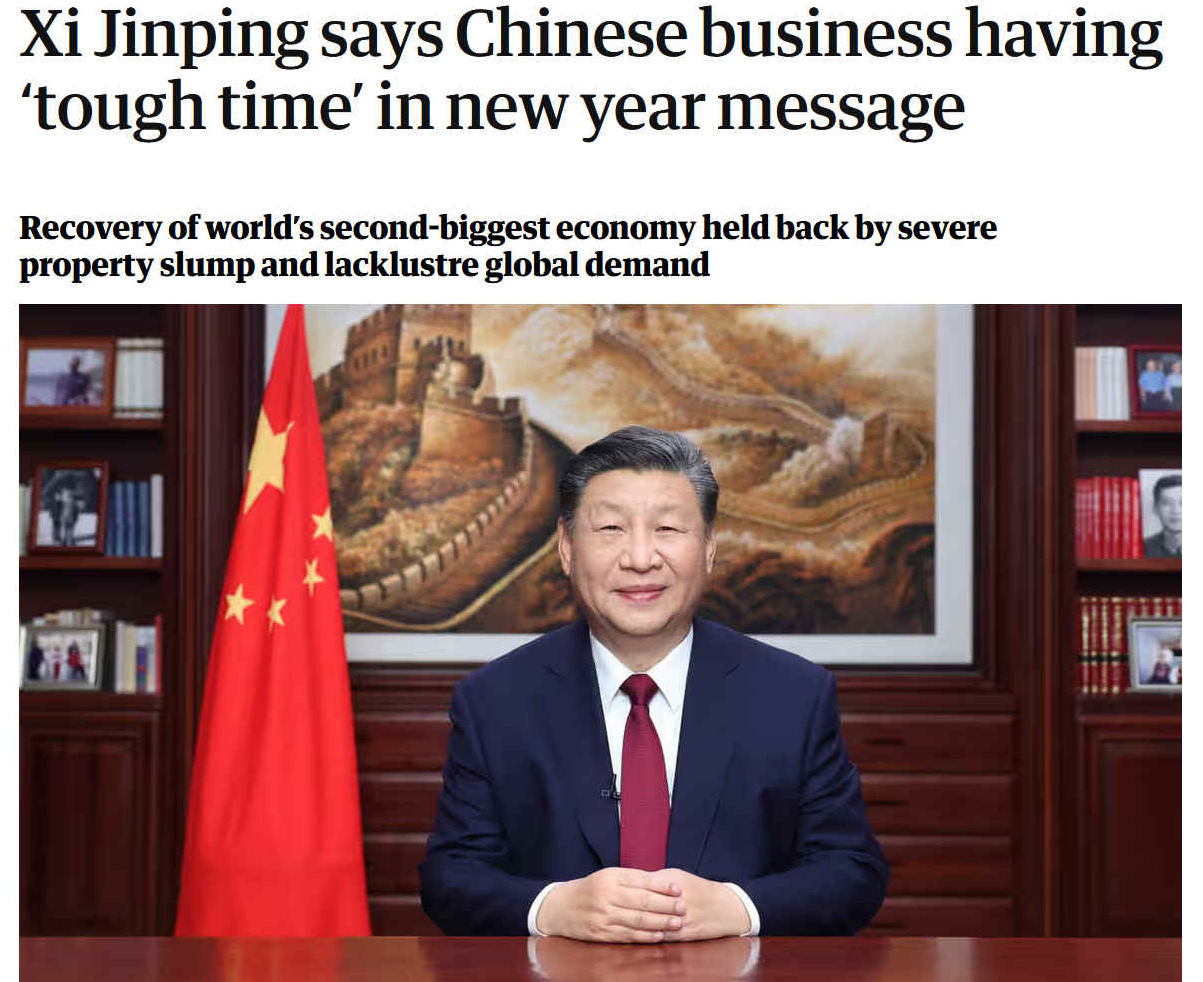

THE GUARDIAN 1 JANUARY 2024 - XI JINPING SAYS CHINESE BUSINESSES HAVING A 'TOUGH TIME' IN NEW YEAR MESSAGE

Recovery of world’s second-biggest economy held back by severe property slump and lacklustre global demand.

China’s president, Xi Jinping, acknowledged in his new year’s message that “some enterprises had a tough time” in 2023 as data showed a weakening of factory production deepened this month, but he vowed to step up the pace of the economy’s recovery.

Speaking on TV, Xi said: “Along the way, we are bound to encounter headwinds. Some enterprises had a tough time. Some people had difficulty finding jobs and meeting basic needs.”

The Chinese leader also reiterated his intention to annex Taiwan, a self-governing democracy which

Beijing claims is a Chinese province, saying it will “surely be reunified”.

The world’s second-biggest economy’s recovery remains sluggish, held back by a severe property slump, lacklustre global demand and record youth unemployment. Evergrande, once China’s biggest developer, has embarked on a painful debt restructuring process, while Country Garden, its main rival, defaulted in October.

China’s factory activity shrank more than expected in December after a decline in new orders.

Clouding the economic outlook, the worse-than-expected figures boosted expectations of fresh stimulus measures in the new year.

Xi said China would “consolidate and enhance the positive trend of economic recovery, and achieve stable and long-term economic development”.

In 2024, the 75th anniversary of the founding of the People’s Republic of China, “we will consolidate and strengthen the momentum of economic recovery, and work to achieve steady and long-term economic development. We will deepen reform and opening up across the board,” he said.

The authorities have cracked down on negative commentary to boost public confidence.

China’s official manufacturing purchasing managers’ index (PMI), a closely watched survey, fell to 49 in December from 49.4 in November, below the 50 mark that divides growth from contraction. This marked the third month of declines and was the weakest reading since June.

New orders were the main drag, sliding to 48.7, while export new orders also worsened, with a reading of 45.8. Production remained in expansion territory but edged lower to 50.2.

“We must step up policy support, otherwise the trend of slowing growth will continue,” said Nie Wen, an economist at Hwabao Trust. Nie expects the central bank to cut interest rates and banks’ reserve requirement ratios in the coming weeks. “Falling prices have greatly affected companies’ profits and further affected people’s employment and incomes. We may see a vicious cycle.”

China’s central bank said on Thursday that it would step up measures to support the economy and encourage a rebound in prices, amid signs of intensifying deflationary pressures. Top Chinese leaders also pledged to take more steps next year at a meeting to chart the economic course for 2024 earlier this month.

Kevin Lam, senior China economist at Pantheon Macroeconomics, said: “Overall, the impact of the recent fiscal stimulus is yet to be felt in the economy. We are still not seeing the reconstruction-related demand being filtered through to the manufacturing sector.

“Externally, demand conditions from China’s key trading partners – the US and EU – are expected to be sluggish in the near term, thanks to elevated interest rates prevailing in those economies. This will further hamper manufacturing production in China … We continue to expect China to rely on fiscal policies, mainly through the fixed asset investment channel to stabilise growth, but don’t expect bazooka stimulus seen during the global financial crisis.”

China’s non-manufacturing PMI, which includes services and construction, rose to 50.4 in December, indicating a modest expansion. The construction index rose to 56.9 in December, as many companies rushed to complete their construction projects before lunar new year in February.

Xi’s address also included slightly stronger language than last year in relation to his wish to annex Taiwan.

“China will surely be reunified, and all Chinese on both sides of the Taiwan Strait should be bound by a common sense of purpose and share in the glory of the rejuvenation of the Chinese nation,” he said, according to the official English translation.

Last year, Xi spoke only of people on either side of the Strait being of the “same family”.

Xi has said he will not renounce using force to achieve what he calls “reunification” of China and Taiwan. In recent years he has overseen an increase in military, diplomatic, and economic coercion in an effort to put pressure on Taiwan. A majority of Taiwan’s people and the three main parties vying for presidency all reject the prospect of Chinese rule.

Taiwan is two weeks out from its own democratic presidential elections, and pressure from Beijing in the form of punitive trade tariffs, military activity, and disinformation has risen, according to Taiwanese officials. Beijing wants to see the ruling Democratic Progressive Party, which it has labeled a party of “separatists” voted out. The DPP have offered talks with Beijing, but have been repeatedly rebuffed.

In her new years day address on Monday, Taiwan’s president Tsai Ing-wen said the will of the people would decided Taiwan’s relations with China and that peace must be based on “dignity”.

“After all, we are a democratic country,” she told reporters.

AFRICAN

ELECTRICITY PRICES

AUSTRALASIAN

ELECTRICITY PRICES

CANADIAN

ELECTRICITY PRICES

CHINESE ELECTRICITY PRICES

EUROPEAN

ELECTRICITY PRICES

MIDDLE

EASTERN ELECTRICITY PRICES

NORTH

AMERICAN ELECTRICITY PRICES

(USA)

RUSSIAN

ELECTRICITY

PRICES

SOUTH

AMERICAN ELECTRICITY

PRICES

SOUTH

ASIAN ELECTRICITY PRICES

UKRAINIAN

ELECTRICITY PRICES

ELECTRICITY

PRICES UNITED KINGDOM

As

you may imagine, if you are running a business that uses lots of energy.

Location is an important factor in remaining competitive. Industry could be

based near the Sahara desert, where massive solar installations make sense.

And yet, there is little by way of industrial activity. Africa, is thus a

blossoming energy market. Recognised in both the EGYPES

and ADIPEC

energy shows. With many other events concentrating on renewables like green hydrogen

and electrolyzers.

The following is a a performance league table for best electricity prices, ranking countries from the cheapest to the most expensive based on the information

available on the web. Remember that these rankings are subject to change over time, but as of the data

available in March 2024, here’s a top ten list:

Sudan: USD 0.006 per kWh (household price)

Kyrgyzstan: USD 0.049 per kWh (household price)

Bulgaria: USD 0.078 per kWh (average household price)

Hungary: USD 0.078 per kWh (average household price)

Malta: USD 0.078 per kWh (average household price)

Kazakhstan: USD 0.079 per kWh (household price)

Uzbekistan: USD 0.080 per kWh (household price)

Tajikistan: USD 0.081 per kWh (household price)

Turkmenistan: USD 0.082 per kWh (household price)

Moldova: USD 0.083 per kWh (household price)

Please note that these rankings may not reflect the current situation. Factors such as subsidies, energy mix, and economic conditions contribute to these prices. We’ll explore the means of electricity generation in more depth later.

Let’s take a look at the electricity prices in Sudan and Kyrgyzstan, along with their potential connections to sustainability and the

United Nations

Sustainable Development Goal 7 (SDG 7).

ELECTRICITY PRICES IN SUDAN

As of June 2023, the price of electricity in Sudan is remarkably low. Here are the details:

- Household Price: SDG 5.000 per kilowatt-hour (kWh) or approximately USD 0.006 per kWh.

- Business Price: SDG 26.000 per kWh or approximately USD 0.029 per kWh.

These prices include all components of the electricity bill, such as the cost of power, distribution, and taxes. For comparison, the average global electricity price during that period was around USD 0.154 per kWh for households and USD 0.151 per kWh for

businesses.

ELECTRICITY PRICES IN KYRGYSTAN

In Kyrgyzstan, the electricity prices are also notably low. As of June 2023:

Household Price: KZT 22.070 per kWh or approximately USD 0.049 per kWh.

Business Price: KZT 28.850 per kWh or approximately USD 0.064 per kWh.

Again, these prices include all components of the electricity bill. Kyrgyzstan’s low electricity prices contribute to its energy affordability for both households and businesses. However, it’s essential to understand the context behind these prices.

POSSIBLE REASONS FOR LOW PRICES

Energy Mix: Both Sudan and Kyrgyzstan have diverse energy sources, including hydropower and other renewables. Hydropower, being a renewable resource, often leads to lower electricity

costs, begging the question why is electricity priced higher in Canada.

Subsidies: Governments in these countries may provide subsidies to keep electricity prices affordable for citizens. These subsidies can help mitigate the cost of power generation.

Economic Factors: Economic conditions, currency exchange rates, and overall development levels influence energy prices. Lower costs of production and distribution can contribute to lower prices.

Historical Context: Historical energy policies and infrastructure investments play a role. For example, Kyrgyzstan has a long-standing tradition of hydropower development.

Connection to SDG 7:

SDG 7 aims to ensure access to affordable, reliable, sustainable, and modern energy for all. Both Sudan and Kyrgyzstan’s low electricity prices align with this goal. By providing affordable energy, they contribute to economic development, poverty reduction, and improved living standards. However, it’s essential to balance affordability with environmental sustainability and climate change mitigation.

Efforts to achieve SDG 7 involve enhancing energy efficiency, promoting renewable energy sources, and fostering international cooperation. Both countries can continue working toward sustainable energy systems while ensuring affordability for their

citizens.

Please note that exchange rates can fluctuate, so it’s essential to check real-time rates for precise conversions.

Anyway you look at it, in the EU consumers are being ripped off, to benefit

rich shareholding investors. Maybe, it's time for change? To allow the

people, to take back control of their energy prices. We cannot help but make

a reference to Financial Slavery at this point. Because, high food and

energy prices lead to food poverty and energy poverty. Kicking in other UN

SDGs: 1,

2,

3

and 10,

11,

12.

BASIC

HUMAN RIGHTS

Electricity

should be cheaply available to all, as a basic human

right. As per Sustainability

Development Goal 7. It is the duty of every government to strive to

achieve affordable clean energy for their administrative geographical region. Profits should not

come into the frame, where it introduces energy poverty, or financial

slavery. Privatization of existing grids can lead to a focus on shareholder profits over

grid modernization and expansion, making electricity less affordable for low-income populations. This is particularly detrimental in developing nations where access to reliable energy is crucial for basic needs and development.

Unfortunately, in China, the total lack of free elections, undermines the

democratic process, regardless of the electricity supply price. Xi Jinping's

dictatorship has allowed property developers to swallow foreign

investment, to build property in China's with little to show for such show

of good faith. Another good reason not to allow foreign investment in land

in another nation. Such practices, if not limited to one house per foreign

national, threatens the sovereignty of the host nation. Apart from the money

laundering element of such transactions.

PROFITEERING

& MORALS

You

may be asking why people should profit from energy and is that legal?

Mostly, energy companies have shareholders who derive an income based on

share dividends. Sometimes those energy companies would rather they grab a

nice profit for themselves, rather than invest in renewables and

infrastructure (storage), to make electricity cheaper for their customers.

If this is happening in your region, it is because politicians are allowing

it to continue. Whereas, policy changes, as statutory requirements - making

it law, could force suppliers to invest first, with dividends later.

Provided that a good level of investment has been made. Otherwise,

suppliers, and of course the infrastructure network (in the UK Power

Networks) should lose their franchise.

THE

CASE FOR NATIONALIZATION

The

alternative is nationalization, where there are no dividends or shareholders

to leach off a captive market. Then, the matter of procurement fraud may

rise to the surface as something to keep an eye open for. As in tender bids

and transparent tendering. A State operated Grid, Power Storage, and State

operated Power Stations, Solar

and Wind

Farms, would seem to be the only way that SDG7 might be complied with.

[1] https://www.statista.com/statistics/1373587/household-electricity-price-china/

[2] https://www.globalpetrolprices.com/China/electricity_prices/

[3] https://www.statista.com/statistics/1373596/business-electricity-price-china/

https://earth-planet.org/ https://earth-planet.org/

[1]

https://www.statista.com/statistics/1373587/household-electricity-price-china/

[2] https://www.globalpetrolprices.com/China/electricity_prices/

[3] https://www.statista.com/statistics/1373596/business-electricity-price-china/

Please

use our A-Z

INDEX to navigate this site

This

website is provided on a free basis to

promote zero emission transport from renewable energy in Europe and Internationally.

Copyright ©

Universal Smart Batteries and Climate Change Trust 2024. Solar

Studios, BN271RF, United Kingdom.

|